Developing a value proposition for Marsh Private

Client: Marsh Private

Sector: Insurance & Risk Management

Deliverables: Value proposition statement, audience segmentation

Case overview

- Led workshops with stakeholders to align Marsh’s offerings with the unique needs of high-net-worth clients.

- Strengthened messaging, enhanced client relationships, and ensured more customised, value-driven offerings.

Background

At Marsh’s Private Client division, I was tasked with refining the way we communicated our specialised services to high-net-worth clients, including C-suite executives, business owners, and families with complex legacy planning needs. To ensure that our messaging resonated with this audience, I used a value proposition builder to help structure and clarify our approach.

Through workshops with key stakeholders, we developed a more tailored communication strategy that aligned Marsh’s services with the expectations and challenges of these clients, ultimately strengthening our value proposition.

The challenge: Aligning value with the complex needs of high-net-worth clients

Our target audience comprised individuals with highly intricate financial needs—C-suite executives, business owners, and families with multi-generational wealth. Many of these clients were managing significant assets, estates, and businesses, which presented several key challenges:

- Lack of trust in brokers: Clients often felt their brokers lacked the depth of insight or expertise to manage their complex portfolios effectively, which led to uncertainty about their coverage.

- Managing complex insurance portfolios: Clients were juggling multiple policies across different insurers, making it difficult and time-consuming to ensure their coverage was comprehensive and aligned with their needs.

- Expectations for VIP service: Given their status, these clients expected a high level of service but often felt overlooked or misunderstood by their current providers.

- Claims management and transparency: They sought clear, transparent pricing and wanted to feel supported during the claims process.

For families with legacy planning needs, the added layer of gatekeepers—such as family office representatives or accountants—made communication and trust-building even more complex.

The solution: Tailoring our approach to address client pain points

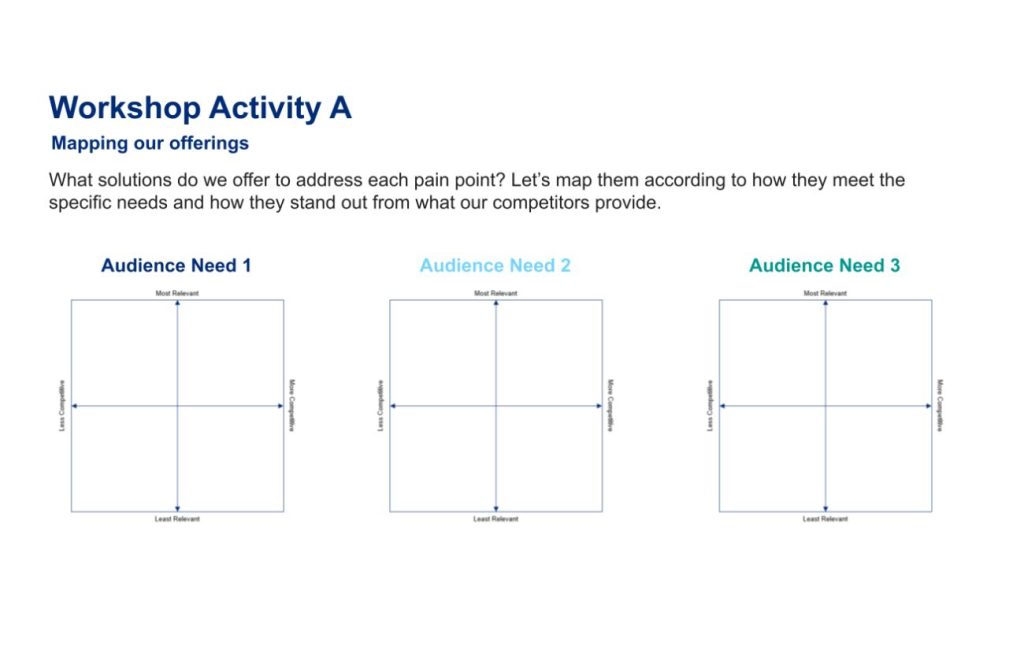

To address these challenges, I facilitated a series of workshops with internal teams and used the value proposition builder to shape our messaging and strategy around high-net-worth clients’ specific needs. Here’s how we approached it:

- Audience segmentation: We segmented our audience to focus on key groups such as C-suite executives, business owners, and families managing multi-generational wealth. This allowed us to craft messages tailored to their specific needs and concerns, including opportunities to engage new clients like family offices or those transitioning from self-managed insurance to broker-led solutions.

- Reframing pain points into benefits: We turned client concerns into positive messaging, highlighting how Marsh could simplify policy management, reduce administrative burdens, and offer the bespoke service they expected. This shift in framing allowed us to better communicate the value of Marsh’s offerings.

- Value-driven communication: High-net-worth clients wanted to clearly understand the value behind Marsh’s services. We focused on showing how our tailored solutions fit their unique lifestyle, assets, and expectations for confidentiality and high-level service.

- Addressing gatekeepers: For clients with family office representatives or other intermediaries, we crafted messaging that built trust and highlighted long-term partnerships, recognising the importance of these key stakeholders in maintaining relationships.

The result: A clear, aligned value proposition for Marsh’s Private Wealth division

By conducting workshops and utilising the value proposition builder, we developed a more structured and effective way to communicate Marsh’s offerings to high-net-worth clients. The outcomes included:

- Stronger trust and confidence: Our refined messaging reassured clients that Marsh was a partner they could rely on for expert, tailored, and transparent solutions. This helped address concerns over inadequate information from previous brokers.

- Simplified insurance management: We clearly demonstrated how Marsh’s services could streamline the management of multiple insurance policies, reducing the administrative burden for time-poor clients.

- Customised solutions for legacy planning: Recognising the role of family office representatives, we crafted messages that addressed their concerns and built trust, fostering long-term partnerships with multi-generational families.

Key takeaways

Tailoring the value proposition to specific audience segments made all the difference in building trust with high-net-worth clients. Understanding their unique challenges, whether it was managing complex insurance portfolios or the need for discreet, VIP-level service, allowed us to craft messaging that truly resonated with them.

Reframing their pain points into clear benefits was a key strategy. By showing how Marsh could simplify their insurance management and provide bespoke solutions, we were able to shift the conversation from challenges to solutions that added real value.

We also found that understanding the role of gatekeepers, like family office representatives, was crucial. Addressing their concerns and building trust with them helped strengthen relationships with families navigating legacy planning.

Ultimately, aligning our messaging with the nuanced needs of this audience helped Marsh create more meaningful connections and offer a clearer, more confident service to high-net-worth individuals.