Streamlining APAC keyword strategy at Genesys

Client: Genesys

Sector: B2B Tech, SaaS

Deliverables: keyword research, search engine optimisation

Case overview

- Developed a points-based rubric to assess keyword value.

- Reduced tracked keywords by 33%, optimising SEMrush costs.

- Prioritised high-impact keywords to improve SEO performance.

- Enhanced competitive standing in the APAC region.

Challenge

At Genesys, we faced a challenge with our keyword strategy in the APAC region. We had a substantial list of 600 tracked keywords, which was overloading our SEMrush account and incurring additional costs. Our goal was to reduce the number of tracked keywords to 400 while ensuring the remaining keywords were of high value and aligned with the company’s objectives.

Solution

To streamline our keyword list by eliminating 200 keywords, focusing on retaining the most impactful and relevant keywords that would drive tangible results and maintain our competitive advantage.

Approach

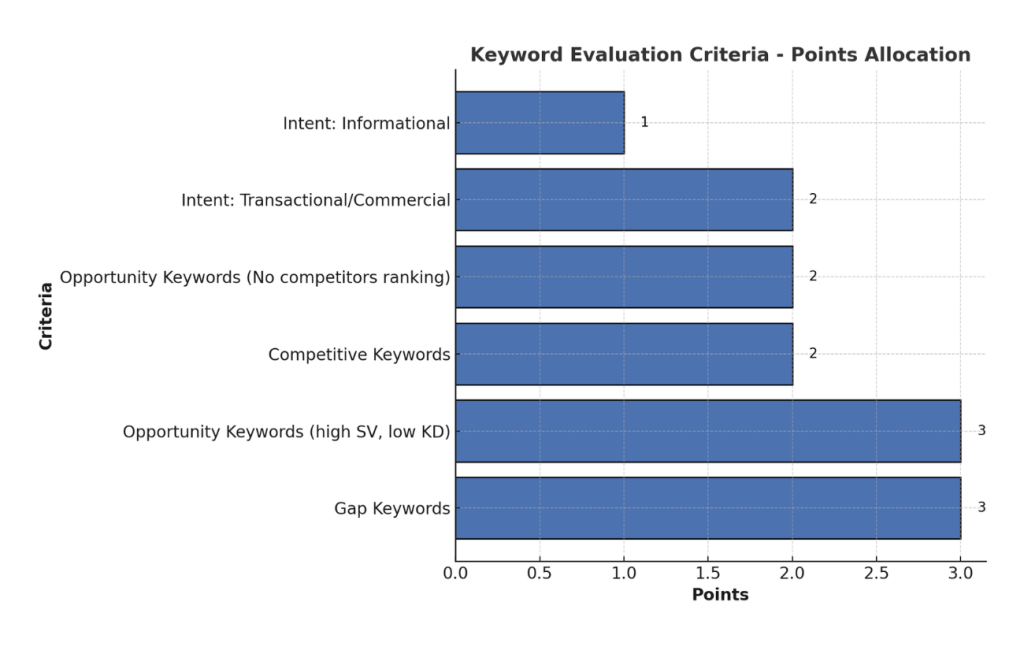

1. Defining Evaluation Criteria To identify high-value and low-value keywords, I established a points-based rubric. Each keyword was evaluated based on several criteria, with each criterion assigned a specific point value:

- Gap Keywords (3 points): Keywords where competitors rank successfully, but Genesys does not.

- Opportunity Keywords (high SV, low KD) (3 points): Keywords that some competitors rank for, which are likely to generate traffic and are moderately easy to rank for.

- Competitive Keywords (2 points): Keywords where at least two competitors are ranking.

- Opportunity Keywords (No competitors ranking) (2 points): Keywords that neither Genesys nor competitors are ranking for, representing untapped potential.

- Intent: Transactional and/or Commercial (2 points): Keywords with strong transactional or commercial intent.

- Intent: Informational (1 point): Keywords offering informational value.

2. Categorising Keywords Based on the total points accumulated from the criteria, I categorised keywords into three value groups:

- High Value (> 8 points): Keywords considered highly valuable and essential to retain.

- Mid Value (3-7 points): Keywords of moderate value, requiring further analysis to determine their importance.

- Low Value (< 3 points): Keywords of lower value, potential candidates for elimination.

3. Data Analysis and Consultation Using SEMrush and other analytical tools, I assessed the current ranking, search volume, keyword difficulty, and intent for each keyword. This quantitative analysis was complemented by qualitative insights from product managers and business development managers who provided context and business relevance.

4. Elimination and Optimisation Keywords falling into the low-value category were marked for potential elimination, but not necessarily removed outright. The decision to retain or eliminate these keywords was made based on their strategic importance and potential future value. High and mid-value keywords were prioritised for retention, ensuring that the keyword list was both impactful and manageable.

Results

By applying this rigorous and methodical approach, I successfully reduced the keyword list from 600 to 400. The refined list consisted of keywords with the highest potential to drive traffic, improve competitive standing, and align with business goals. This not only optimised our SEMrush usage and costs but also strengthened our SEO strategy, ensuring a more focused and effective keyword targeting approach.

The structured, points-based evaluation rubric provided a clear and objective method to streamline the keyword list. This approach enabled us to focus on high-impact keywords, enhancing overall SEO performance and maintaining a competitive edge in the APAC region. The case study underscores the importance of combining quantitative data analysis with qualitative business insights to make informed strategic decisions.

Key takeaways

- Establish clear evaluation criteria with assigned point values to assess keyword importance.

- Combine quantitative analysis with qualitative insights for a comprehensive evaluation.

- Focus on high and mid-value keywords while strategically assessing the potential of low-value keywords.

- Regularly review and adjust the keyword strategy to align with evolving business goals and market conditions.